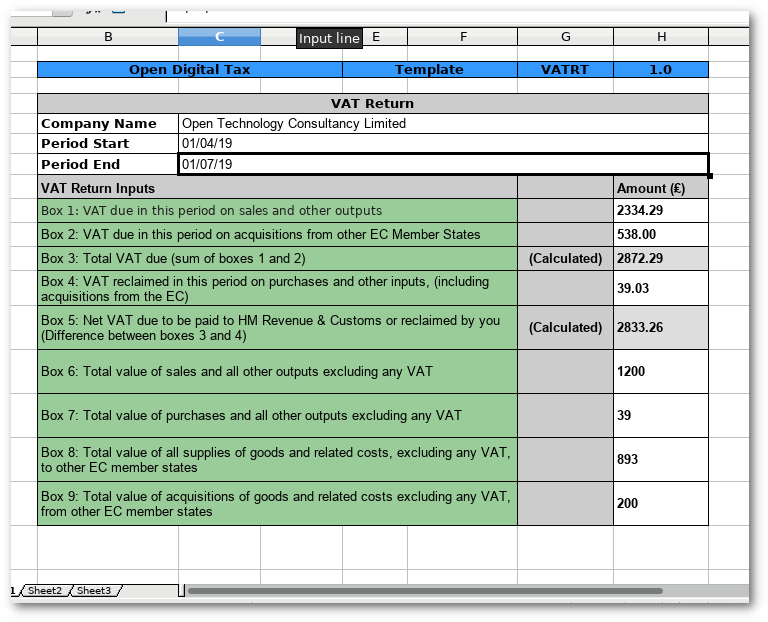

Once the document is opened, you will see some fields that should be entered for your records, namely:

- Company name

- Period start

- Period end

After this, please work down the fields in Column H to provide each of figures required for your VAT Return. Some of the cell (H11 and H13) are auto-calculated from the other fields, so these will be populated automatically. There are a couple of points to note when filling in column H:

- The Totals (H14 -> H19) should be pounds only, no pence. You will receive and error if you provide pence here.

- Do not move around or reformat the spreadsheet in any way. Again, if you do this you will receive an error.

After the spreadsheet has been completed, first save it as a normal spreadsheet in the format of your choice, .xls or .ods are the most common. After that save the file as a CSV (comma separated values). This is normally done by:

- Select 'Save as'

- Choose format of CSV (.csv) from dropdown list

- Click Save

- If prompted, choose 'Comma' as the delimiter (not tab or anything else)

This will now be saved as (say) q3_2019.csv. This file is now ready to be imported.